fidelity tax-free bond fund by state 2019

For instance coupon payments for muni bonds sold to fund those activities are federally taxed with one common example is a bond issued to fund a states pension plan obligation. Omission of Shareholder Proposal Fidelity Freedom 2020 Fund Fidelity Freedom 2025 Fund and Fidelity Advisor Municipal Income Fund August 12 2015.

Measuring The Ivy 2020 First Take Markov Processes International Style Analysis Ivy League Schools Ivy

Harris Liberty All-Star Equity Fund May 6 2015.

. Mutual Funds and Mutual Fund Investing - Fidelity Investments. Fidelity Global Bond Fund Return of Capital 03-04-2015 PDF Fidelity International Bond Fund Return of Capital 03-04-2015 PDF. The Lord Abbett Short Duration Income Fund seeks to deliver a high level of current income consistent with the preservation of capital.

Omission of Shareholder Proposal Submitted by Steven N. 2019 Fidelity mutual funds corporate actions. AJ Bell Favourite funds Funds can make investing easier.

1991 0418. Once you reach 59½. If you live in a state that celebrates the Patriots Day holiday such as Maine and Massachusetts you have until April 19 2022 to file your taxes.

Certified shareholder report of registered. No picking individual stocks and shares no spending hours researching individual companies. How do you begin to know which to choose.

225 for class A of Putnam Floating Rate Income Fund Short-Term Municipal Income Short Duration Bond Fund and Fixed Income Absolute Return Fund. 4 and 5 stars among 556 491 and 318 Short-Term Bond Funds for the overall rating and the 3 5 and 10 year periods ended 4302022 respectively. By clicking Accept All Cookies you agree to the storing of cookies on your device to enhance site navigation analyze site usage and assist in our marketing efforts.

Muni national long portfolios invest in bonds issued by various state and local governments to fund public projects. Those contributions any time tax-free and penalty-free. 02 OCP CLO 2016-12 Ltd.

View prospectus and more. Morningstar calculates these risk levels by looking at the Morningstar Risk of the funds in the Category over the previous 5-year period. Clicking a link will open a new window.

2019 Apr Jul Oct 2020 Apr. Vanguard UK Investment Grade Bond Index Fund IE00B1S74Q32 OCF 012. Fidelity AMT Tax-Free Money Fund merger into Fidelity Tax-Exempt Fund PDF.

The Lord Abbett Bond Debenture Fund seeks to deliver high current income and long-term growth of capital. The income from these bonds is generally free from federal taxes. Fidelity Guaranty Life Holdings Inc.

IShares Corporate Bond Index Fund GB00B84DSW83 OCF 011. US government holds Treasury bonds and others from federal agencies. Municipal buy tax-free bonds from local and state governments.

Despite bad times certain industries still grow. Shareholder Proposal Clough Global Equity Fund April 16 2015. Credit Suisse Mortgage Capital Certificates 2019-ICE4.

Fidelity Global Credit Fund Return of Capital PDF. Morgan offers several different strategies to help clients reduce taxes including tax-free municipal bond funds investing for dividends contributing as much as possible for tax. Key Factors That Allowed Fidelity to Rank as One of the Best Investment Firms.

Concluding thoughts on low-cost index funds and ETFs. IShares Core Corporate Bond ETF SLXX OCF 02. But there are thousands of funds to choose from spread across multiple sectors regions asset classes and investment strategies.

High-quality corporate only chooses from the top-tier companies. Global has either the US or foreign bonds. 10 Biggest.

When this type. 03 Colombia Government International Bond. Securities and exchange commission.

Morningstar Risk is the difference between the Morningstar Return based on fund total returns and the Morningstar Risk Adjusted Return based on fund total returns adjusted for performance volatility. Best performing mutual funds you need during a recession. Fidelity Tax-Free Bond Fund FTABX.

For class A and class M shares the current maximum initial sales charges are 575 and 350 for equity funds and 400 and 325 for income funds respectively with these exceptions. A good strategy is to buy a few higher-yielding longer-term munis plus a fund such as Fidelity Tax-Free Bond symbol FTABX which owns a. IShares UK Credit Bond Index Fund IE00BD0NC474 OCF 01.

The Presidency Annual Performance Plan 2018 2019

Chapter 6 Power To The Investors Cairn International Edition

Unesco In The Media Asia Pacific Region 2018 2019 Press Review And Clippings

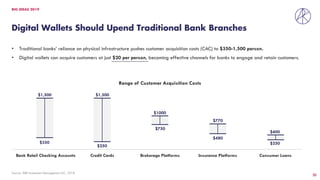

Innovation Is Key To Growth Big Ideas 2019 Ark Invest

Innovation Is Key To Growth Big Ideas 2019 Ark Invest

Income Tax And Capital Gains Rates 2019 03 01 19 Skloff Financial Group

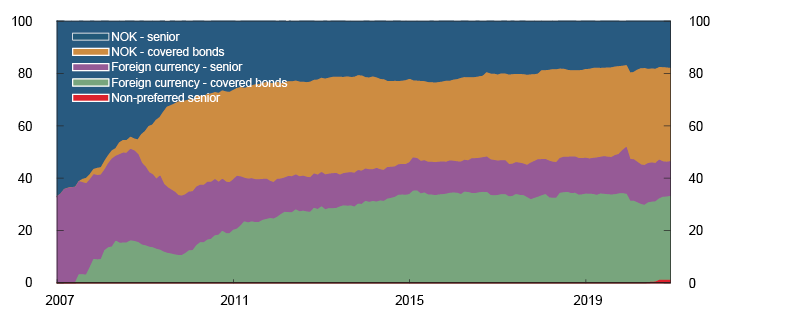

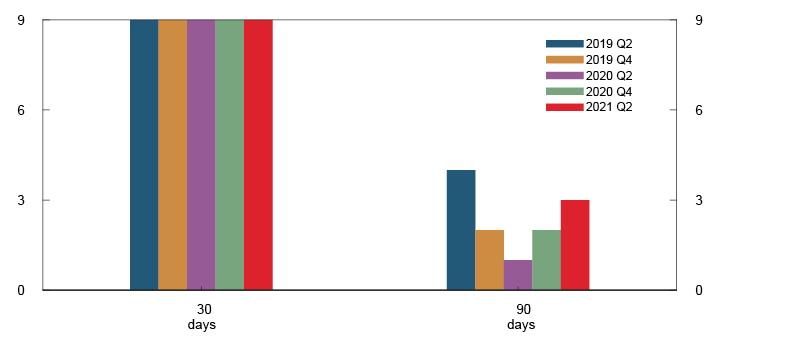

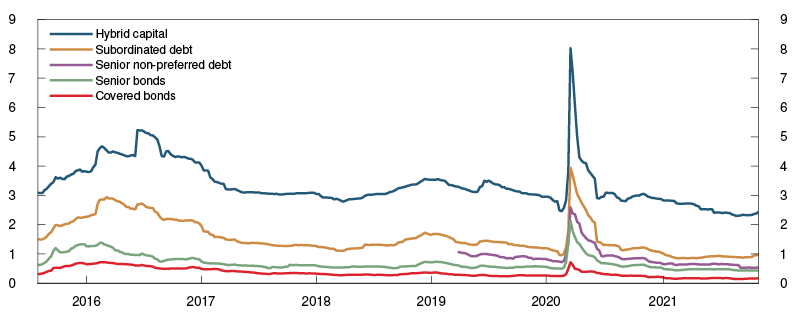

Financial Stability Report 2021 Vulnerabilities And Risks

Financial Stability Report 2021 Vulnerabilities And Risks

Financial Stability Report 2021 Vulnerabilities And Risks

The Presidency Annual Performance Plan 2018 2019

Pdf Cause Specific Mortality Of The World S Terrestrial Vertebrates

Fidelity Total Bond Video Video Fidelity Institutional

2019 Supplemental Tax Information Resources Financial Alternatives